Up to £200,000 - Nil

If you are interested in purchasing a property in Gibraltar, there are a number of legal and tax issues which require consideration.

The Gibraltar Government owns the land in all modern developments in Gibraltar. Typically, the Government grants a lease to the development company for 150 years. The development company then sells each property on the land to purchasers, either in their individual capacity or in the capacity as a company. The purchaser therefore receives a lease over the property for 150 years less 7 days.

Freehold property and Flying Freehold property does still exist in Gibraltar but such properties are few and far between. In the event that you are considering purchasing such class of property, it is recommended that you seek legal advice.

In most leasehold purchases, the estate where the property is situated is managed by a management company. The Purchaser of the property will ordinarily be required to pay service charges on a quarterly or annual basis.

The Gibraltar Stamp Duties Act 2005 was recently amended with effect from the 1st July 2010. Under such amended provisions, stamp duty will be levied on the purchase price of properties as follows:

No stamp duty is payable by first and second time buyers (excluding corporate entities) on the first £300,000 of the purchase cost. Stamp duty on transfers of properties between spouses is nil.

A special rate of stamp duty of 7.5% is payable on the sale of affordable housing developed by Government within the first 10 years since original purchase. The duty is not payable in circumstances of a forced sale, including in the cases of divorce or where a family moves to a larger property as a meritorious upgrade to another, newer, Government affordable housing estate.

Individuals who wish to enjoy the benefits of Mediterranean living in a beneficial tax environment need no longer look beyond Gibraltar. Under the Qualifying (Category 2) Individual Rules 2004 individuals in possession of a Qualifying Certificate are liable to tax only on the first £80,000 of assessable income. Under the rates of tax currently enforced in Gibraltar, the maximum liability to tax for such individuals would be approximately £26,000 per annum. There is, however, a minimum tax of £22,000 per annum, payable irrespective of the individual’s income in that year of assessment.

Only individuals not currently resident in Gibraltar and who have not been resident in any of the previous five years of assessment may apply for a Qualifying Certificate.

Such applications should be made to the Finance Centre Director of Gibraltar and must be accompanied by two references, one of which must be from a bank confirming that the applicant holds assets in excess of £2,000,000.00. The application itself also comes with a non-refundable fee of £1,000.

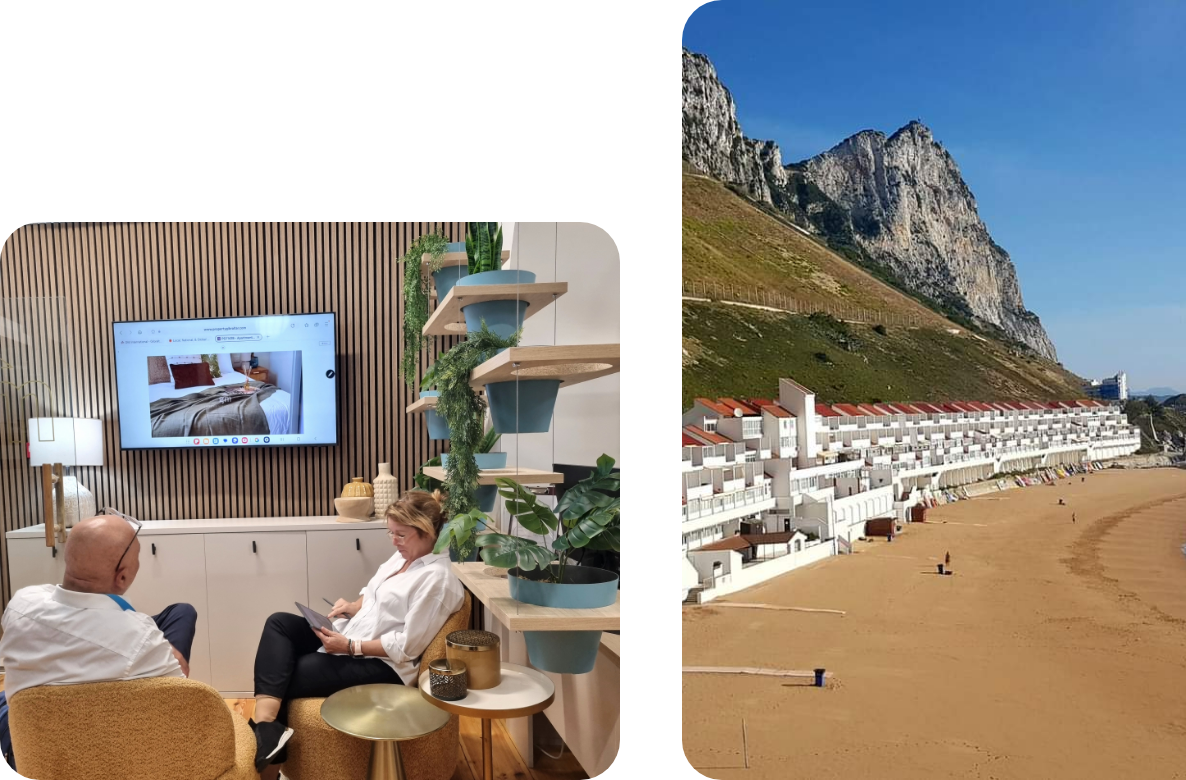

In order to be successful the applicant must have, for the exclusive use of himself and his family, approved residential accommodation in Gibraltar. We at GM International Homes have a wide and varied selection of high quality developments in Gibraltar which would be suitable as an approved property, as well as other properties located in and around the town centre.

Details of the property acquired or rented must then be forwarded to the Finance Centre Director within two months of the issue of the Qualifying Certificate. The Finance Centre Director may decide whether or not a property is an approved property. This usually consists of verifying that the size and type of property is consistent with the size and make up of the applicant’s family and the applicant’s status as a Qualifying Individual.

Contact GMI today to buy or sell your property with expert guidance and exceptional service.